13th Month Pay And Other Benefits Ceiling

The amendment stipulates that the 13th month pay and other equivalent benefits shall not be subject to tax for a maximum of P90000. Increase In The Ceiling Of 13th Month Pay And Other Benefits Memoentry 13th Month Pay Paperblog Revised Guidelines On The Implementation Of 13th Month Pay Law How To Compute Your 13th Month Pay Blog 7 Things You Need To Know About Your Christmas Bonus Abs Cbn News 13th.

De Minimis Benefits Explained Memoentry

10653 Congress of the Philippines 12 February 2015.

13th month pay and other benefits ceiling. Otherwise be subject to income tax rate under TRAIN Law. Under current law or Republic Act 10653 the 13th month pay and other benefits including productivity incentives and Christmas bonuses are exempted from tax if they do not exceed P82000. Other benefits are the 13th-month pay of 20 000 and other benefits of 80 000.

An act adjusting the 13th month pay and other benefits ceiling excluded from the computation of Gross Income for purposes of income taxation. Amends Section 32 B Chapter VI of the NIRC b. Approved on February 12 2015.

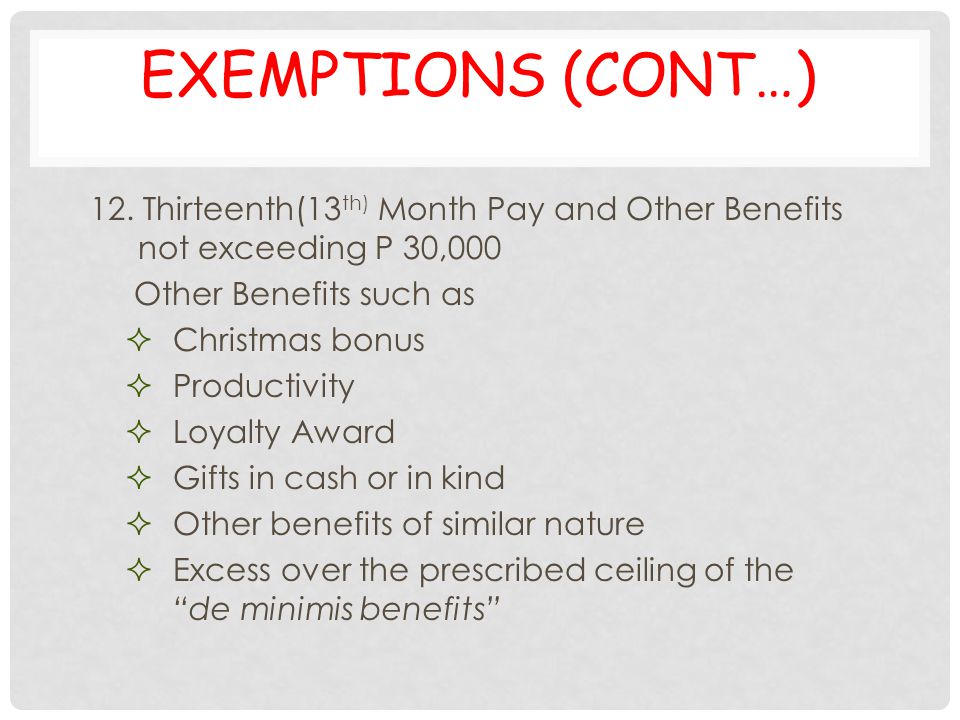

Old ceiling of 13th month pay and Other benefits is P3000000. The amount included in the list of the de minimis shall not be considered as part of the P90000 ceiling of the 13th month pay bonuses and other benefits that are excluded from gross income in the computation of the taxable income. Any company that hires employees internationally is required to comply with the host countrys employment and compensation laws and labor rights.

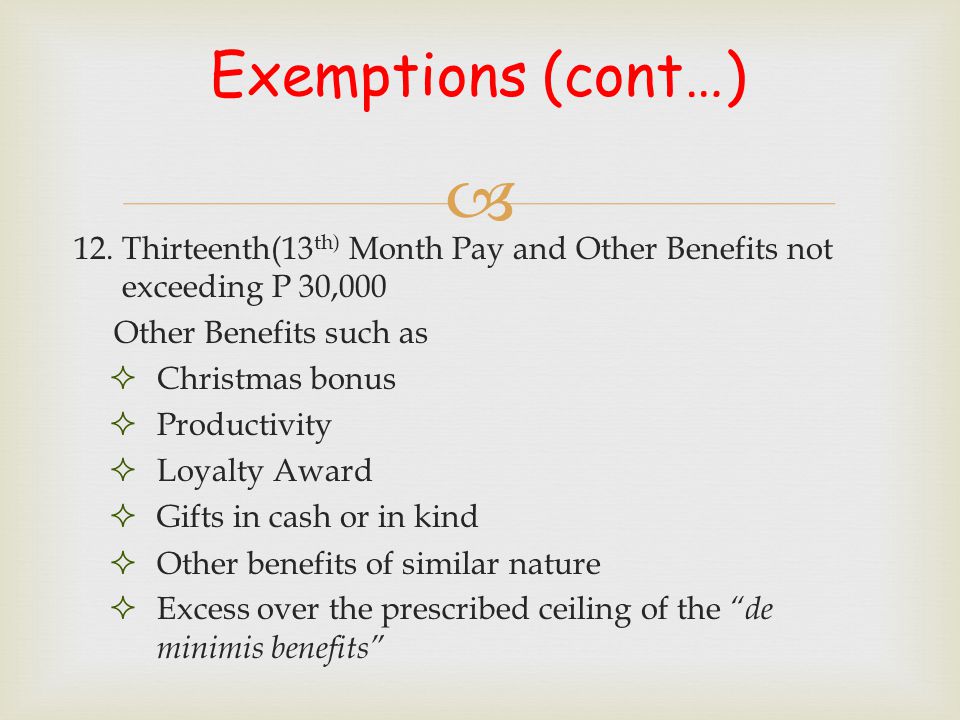

Before RA 10653 was signed into law in 2015 only bonuses not exceeding P30000 were tax-exempt. An act adjusting the 13th month pay and other benefits ceiling excluded from the computation of gross income for purposes of income taxation amending for the purpose Section 32b Chapter VI of the National Internal Revenue Code of 1997 as amended. In other words if other benefits and the 13 th month pay combine to a total of less than PHP 90000 US1778 no tax is to be paid.

Be it enacted by the Senate and House of Representatives of the. AN ACT ADJUSTING THE 13TH MONTH PAY AND OTHER BENEFITS CEILING EXCLUDED FROM THE COMPUTATION OF GROSS INCOME FOR PURPOSES OF INCOME TAXATION AMENDING FOR THE PURPOSE SECTION 32B CHAPTER VI OF THE NATIONAL INTERNAL REVENUE CODE OF 1997 AS AMENDED. 13th Month Pay and Other Benefits Revised Ceiling of 13th Month Pay and Other Benefits.

Begun and held in Metro Manila on Monday the twenty-eighth day of July two thousand fourteen. Total exclusion total exclusion shall not exceed eighty-two thousand. This is however subject to the rule on the P90000 amount for 13th month pay and other benefits where excess de minimis benefits may not be taxable if the total of such excess plus the 13th month pay and other benefits is within the P90000 limitation.

However there is a prescribed limit to this exemption provided under Section 32 B7e of the National Internal Revenue Code NIRC which was amended by Republic Act No. 13th month pay and other benefits 13th month pay paperblog the 13th month pay law how to compute your 13th month pay blog. An Act Adjusting the 13th Month Pay and Other Benefits Ceiling Excluded from the Computation of Gross Income for Purposes of Income Taxation Amending for the Purpose Section 32 B Chapter VI of the National Internal Revenue Code of 1997 as Amended Republic Act No.

Employers can pay the 13th Month Pay benefit in installments but remember. Time of Payment of 13th Month Pay Employers in the Philippines are required to pay the 13th Month Pay to all relevant employees on or before 24 December each year. The amount included in the list of the de minimis shall not be considered as part of the P82000 ceiling of the 13th month pay bonuses and other benefits that are excluded from gross income in the computation of the taxable income.

Miscellaneous Items 13th Month Pay and Other Benefits b. Last if the total taxable income is below 250 000 it is non-taxable. AN ACT ADJUSTING THE 13th MONTH PAY AND OTHER BENEFITS CEILING EXCLUDED FROM THE COMPUTATION OF GROSS INCOME FOR PURPOSES OF INCOME TAXATION AMENDING FOR THE PURPOSE SECTION 32 B CHAPTER VI OF THE.

Other benefits fall into the same category as the 13 th month pay and are subject to the same PHP 90000 limit US1778. 10963 or the TRAIN law on January 2018. 13th-month payalso sometimes referred to as the 13th-month bonus 13th-month salary or thirteenth salaryis a monetary benefit that is either mandatory by law or customary for the countries that participate.

The excess amount however of the de minimis benefits can be included as part of the P90000 ceiling and will be exempt as long as the total 13th month pay bonuses and other benefits do not exceed the P90000 ceiling. B received a rice allowance of 2 500 and a clothing allowance of 10 000 from his employer. This new amount is a relative increase.

View 13th Month Pay and Other Benefitsdocx from MANAGEMENT MISC at University of San Carlos - Main Campus.

Http Www Chanrobles Com Pdf Laws Revised 20guidelines 20on 20the 20implementation 20of 20the 2013th 20month 20pay 20law Pdf

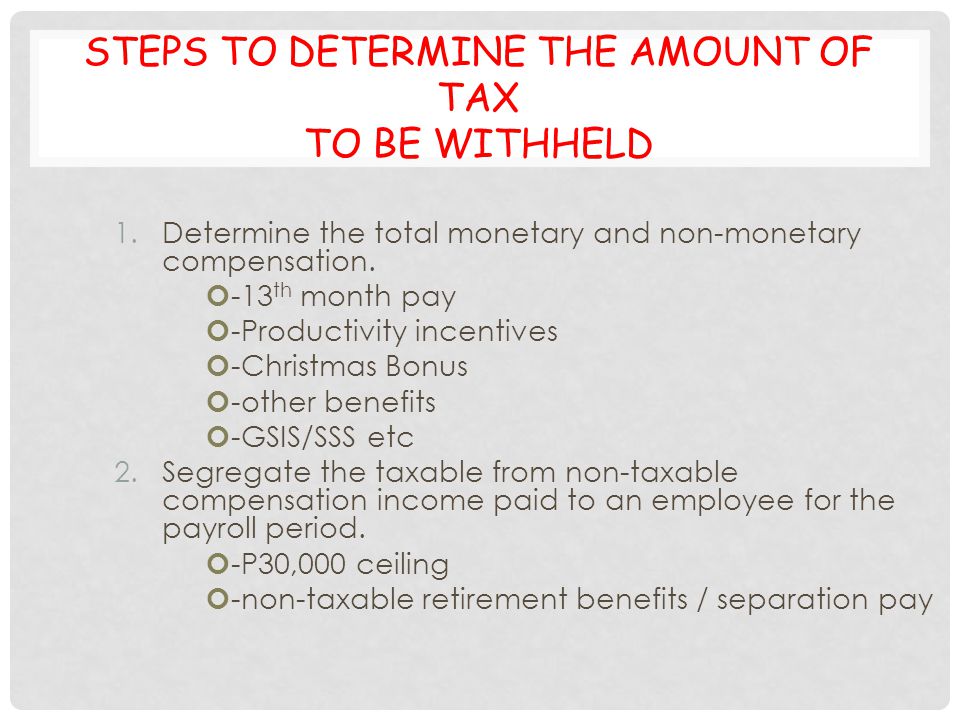

Withholding Tax On Compensation Ppt Video Online Download

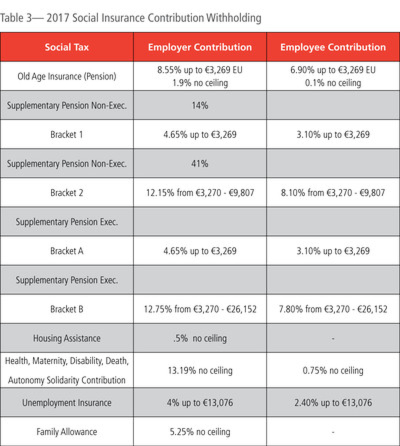

Country Spotlight What To Know About Payroll In France

De Minimis Benefits Sample Computation For Ncr Employees Lvs Rich Publishing

13th Month Pay An Employer S Guide To Monetary Benefits

Hiring Remote Workers In France A Guide For Us Employers

Withholding Tax On Compensation Ppt Video Online Download

Https M5 Paperblog Com I 106 1064677 13th Month Pay L Wlwizk Jpeg

13th Month Pay An Employer S Guide To Monetary Benefits

De Minimis Benefits Explained Memoentry

Withholding Tax On Compensation Revenue Regulations No 2

Increase In The Ceiling Of 13th Month Pay And Other Benefits Memoentry

Country Spotlight What To Know About Payroll In France

Withholding Tax On Compensation Revenue Regulations No 2

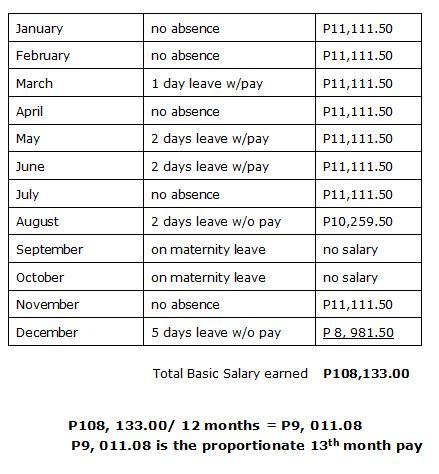

How To Compute Your 13th Month Pay Blog

13th Month Pay An Employer S Guide To Monetary Benefits

Withholding Tax On Compensation Ppt Download

13th Month Pay Law Employee Benefits Piece Work

Withholding Tax On Compensation Revenue Regulations No 2

Post a Comment for "13th Month Pay And Other Benefits Ceiling"