Monthly Salary Calculator Arizona

Filing as a single person in Arizona you will get taxed at a rate of 259 on your first 26500 of taxable income. All new employers should use a flat rate of 20.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

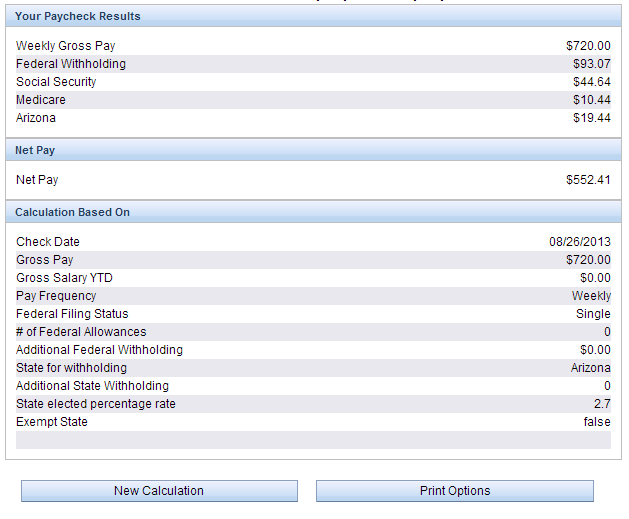

Monthly salary calculator arizona. Each of these match the federal standard deduction. 14500000 salary example for employee and employer paying Arizona State tincome taxes. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On.

On the first 7000 each employee earns Arizona employers have to pay unemployment insurance of between 008 to 2060. 334 up to 53000. If you choose not to itemize on your Arizona tax return you can claim the Arizona standard deduction which is 12400 for single filers 24800 for joint filers and 18650 for heads of household.

Arizona State Unemployment Insurance. The table below details how Arizona State Income Tax is calculated in 2021. One of a suite of free online calculators provided by the team at iCalculator.

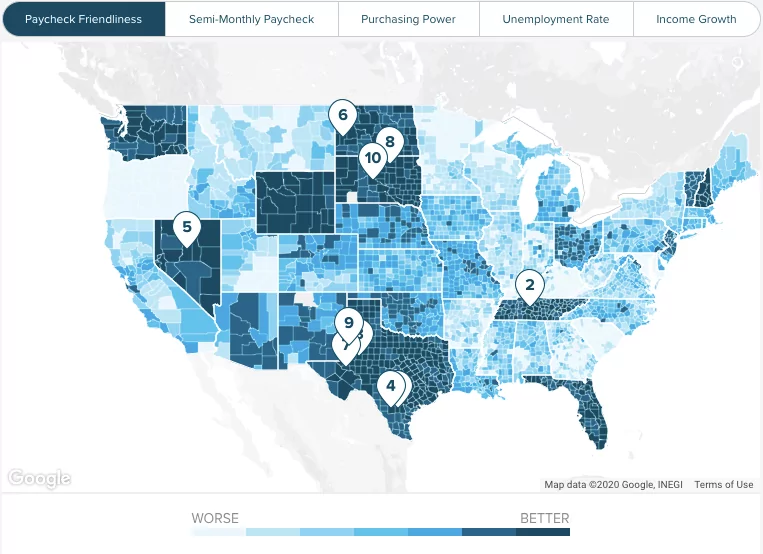

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. We use the Consumer Price Index CPI and salary differentials of over 300 US cities to give you a comparison of costs and salary. Calculate your Arizona net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Arizona paycheck calculator.

Arizona Hourly Paycheck Calculator. Also known as Gross Income. All bi-weekly semi-monthly monthly and quarterly figures.

Salary Before Tax your total earnings before any taxes have been deducted. This Arizona hourly paycheck calculator is perfect for. Detailed salary after tax calculation including Arizona State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Arizona state tax tables.

23 lignes Typical Annual Salary. One of a suite of free online calculators provided by the team at iCalculator. 7500000 salary example for employee and employer paying Arizona State tincome taxes.

30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. If you decide to file jointly or as a head of household as in youre the only one in your home. Monthly Pretax Income Monthly taxes 25 Monthly Post-tax Income.

417 up to 159000. Management 95716 Business Financial Operations 64473. Itemized deductions in Arizona track very closely to federal itemized deductions.

Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. Management 95716 Business Financial Operations 64473. The Income Tax calculation for Arizona includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Arizona State Tax Tables in 2021 Federal Tax Calculation for 3500000 Salary 3500000 Federal Tax Calculation.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Arizona. 23 lignes Typical Annual Salary. Cost of Living in Arizona.

As of Jul 22 2021 the average annual pay for the Average jobs category in Arizona is 57091 an year. Youll then get a breakdown of your total tax liability and take-home pay. The adjusted annual salary can be calculated as.

The Arizona Salary Calculator allows you to quickly calculate your salary after tax including Arizona State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Arizona state tax tables. And 450 on income beyond 159000. Arizona Salary Paycheck Calculator Results Below are your Arizona salary paycheck results.

How much does an Average make in Arizona. One of a suite of free online calculators provided by the team at. The results are broken up into three sections.

Detailed salary after tax calculation including Arizona State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Arizona state tax tables. Note that these are marginal tax rates so the rate in question only applies to the income that falls within that bracket. This is what you need to pay in full and on.

Just in case you need a simple salary calculator that works out to be approximately 2745 an hour.

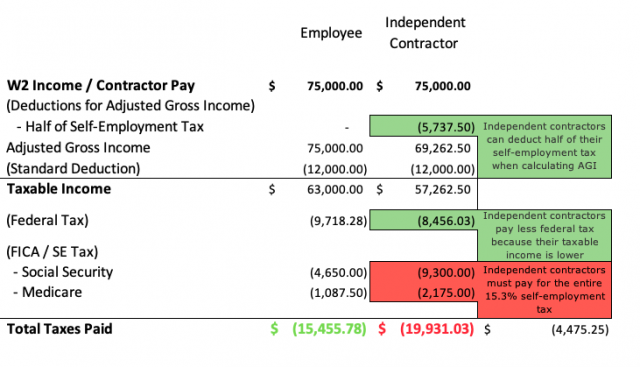

How Much Should I Set Aside For Taxes 1099

Hawaii Paycheck Calculator Smartasset

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

Earning Yield Calculator Www Investingcalculator Org Earnings Calculator Html Investing Investment Calculator Financial Calculators Earnings Calculator

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator Take Home Pay Calculator

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

Arizona Child Support Calculator Guidelines Child Support Com

Arizona Unemployment Calculator Fileunemployment Org

The Salary Calculator Irish Take Home Tax Calculator Salary Calculator Weekly Pay Salary

Arizona Paycheck Calculator Smartasset

This Is How Much Money You Save On H1b L1 Visa In Us 2021

Quickbooks Job Costing From A Z Webinar Quickbooks Learn Accounting Job

Salary Sheets Salary Slips And Salary Slip Formats In Sri Lanka

Https Superiorcourt Maricopa Gov Media 4903 Drs1z Pdf

Arizona Paycheck Calculator Smartasset

Here S What Your Salary Should Be To Afford An Average Arizona Home

Post a Comment for "Monthly Salary Calculator Arizona"