13th Month Pay Philippines Calculator

Take note though that this only calculates the ESTIMATED Proportionate Amount. If an employee worked for 10 months of the year and had 2 months unpaid leave and the basic monthly pay is P15000 then the 13 th month pay will be.

How To Compute 13th Month Pay A Complete Guide For The Ph

In this case the 13 th month pay will be P15000.

13th month pay philippines calculator. The 13th-month pay is computed based on 112 of the total basic salary of an employee within a calendar year or your basic monthly salary for the whole year divided by 12 months. P150000 12 P12500. Again certain types of earnings are not included as a basic pay for purposes of computing the 13th-month pay see definition of basic salary.

Monthly Basic Salary x Employment Length 12 months For employees who worked less than 12 months they will receive a prorated 13th month pay based on the number of months you worked for the company. This is the case in the Philippines. You then paid them 15000 as their thirteenth month.

If you divide that by 12 it. So an employee paid 24000 per year will receive an extra 2000 for their 13th-month pay because 24000 divided by 12 is 2000. According to Philippine Law the 13th month pay is one-twelfth 112 of the basic salary of an employee within the calendar year and should be paid in cash ONLY and NOT in kind products airfare other non-monetary rewards.

December - P 1000000. November - P 1000000. If that employee earned 20000 for 11 months their base pay is at least 220000 pesos for the year.

Others company name incentive 9252009 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000 000. Lets say youre employee earned 20000 a year but in November you reduced their salary to 15000. To put it simpler just get the sum of your basic salary for the calendar year then divide it by twelve.

Ive created an on-page 13 th Month Pay Calculator to help my fellow workers out there in projecting the amount that they will be receiving this coming December. When do employers pay the 13th month salary in the Philippines. The employee will get P12500 as the 13 th month pay.

13th-month pay is usually exempt from any taxes. However any payments over the one-twelfth denomination of the employees basic salary are taxable. P 833333 is the proportionate 13th month pay of a female employee who was on maternity leave from June 1 to July 31 2013.

All rank and file employees regardless of their designation or employment status who have worked at least one month during the calendar year are entitled to a 13th month pay. Sweldong Pinoy is a salary calculator for Filipinos in computing net pay withholding taxes and contributions to SSSGSIS PhilHealth and PAG-IBIG. Others tardiness loan received by.

Total basic salary 12 13th month pay. October - P 1000000. For example the exclusion rate in the Philippines is P90000the maximum amount allowed without taxation.

This calculator is by no means an exact representation of what you will receive. Here is the basic 13th month pay formula in the Philippines. The formula used in the Philippines is.

So it is equivalent to one months salary of that year. September - P 1000000. The following are NOT included in its computation.

Overtime min pay adjustments amount deduction 13th month wh tax gross pay. This law is called the. In some countries like in the Philippines 13th-month pay is calculated as an additional months salary.

Paid leaves philhealth holiday pay pag-ibig net pay. How to Compute the 13th Month Pay. 13th month pay is equal to the Total basic salary EARNED during the year divided by 12.

In other countries such as Brazil and Italy 13th-month pay is calculated as part of the annual salary. How to Compute 13th-Month Pay. Contributions for SSS and PhilHealth are increasing on 2021.

The 13th month pay shall be in the amount not less than 112 of the total basic salary earned by the employee within the Calendar day. To compute your last pay. A new employee who works more than one month but less than a year would receive an amount equal to the years accrued salary to date divided by 12.

In the Philippines there is a law that says Filipino employers must pay their employees a bonus that is equal to one months salary. 13th month pay is calculated by dividing the annual basic salary by 12 and that amount would be the 13th month. In some countries 13th month pay is calculated as an additional salary.

The amount of the 13th-month pay shall not be less than 112 of the total basic salary earned by the employee within a calendar year.

Philippine Payroll How To Pay Employees Their 13th Month Pay Youtube

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

How To Compute For 13th Month Pay Philippines Kg Consult Group Inc

Dole Guidelines For 13th Month Pay In Private Sectors

How To Calculate Prorated 13 Month Bonus

How To Compute Your 13th Month Pay In Philippines

13th Month Pay 2020 Dole Labor Advisory 28 Train Law Compute Thirteenth Covid19 Pandemic Kasambahay Youtube

How To Compute 13th Month Pay 13th Month Pay Months Computer

How To Compute Your 13th Month Pay In Philippines

How To Compute 13th Month Pay Explaining In Details Kami Com Ph

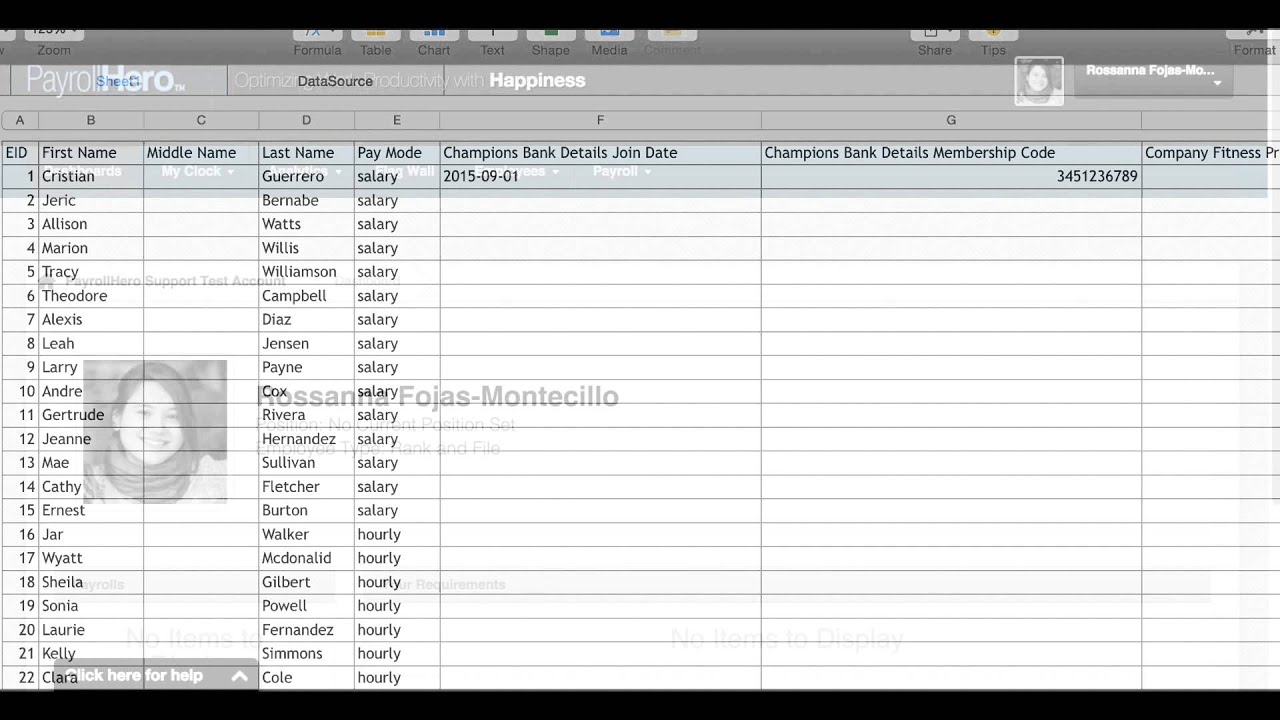

How To Compute The 13th Month Pay Payrollhero Support

How To Compute For 13th Month Pay In The Philippines Coins Ph

How To Compute Your 13th Month Pay In Philippines

Computation National Wages And Productivity Commission Facebook

Back Pay Computation And Guide For Working Filipinos

13th Month Pay Computation Dole Labor Advisory

13th Month Pay Computation Dole Labor Advisory

10 Things You Should Know About 13th Month

13th Month Pay In The Philippines Computation And Guide

Post a Comment for "13th Month Pay Philippines Calculator"