Net Income Meaning Canada

Its targeted toward low-income seniors and can help them bridge the income. Net Income.

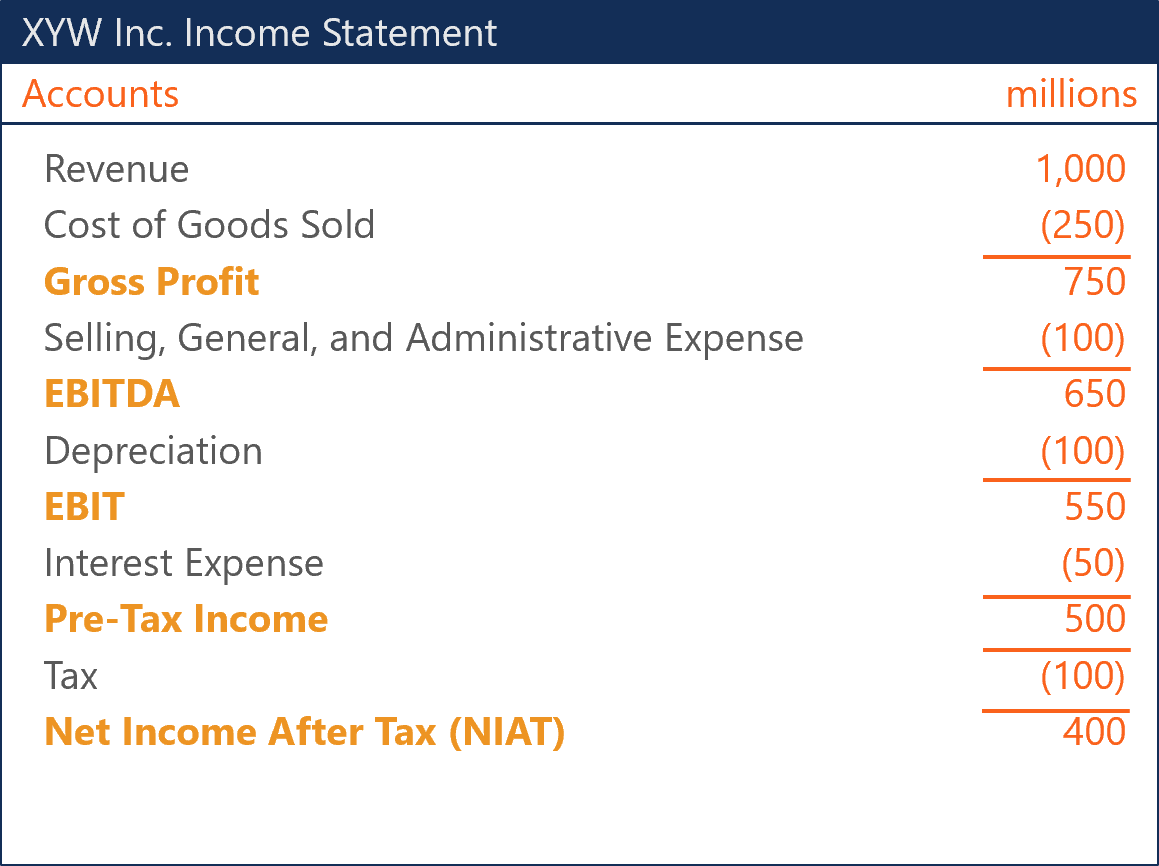

Net Income After Tax Niat Overview How To Calculate Analysis

If you do not know if your employer is a prescribed international organization contact your.

Net income meaning canada. You serve time in federal prison for a sentence of two years or longer. Net income is the money that you actually have available to spend. Please try again later.

Dictionary of Financial Terms. Cost of revenue operating expenses interest taxes and others. An error occurred while retrieving sharing information.

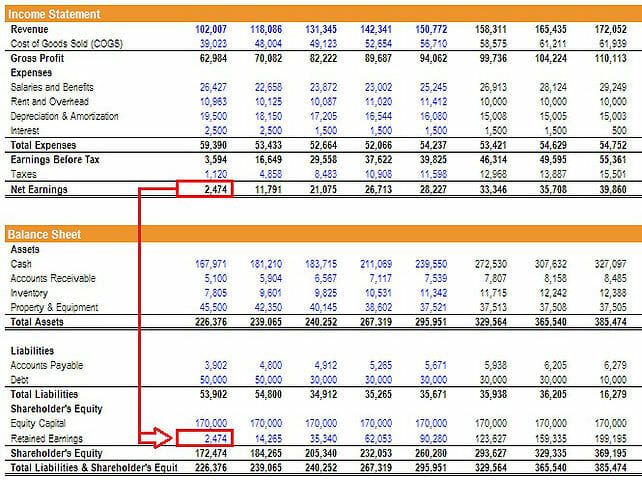

The CRA also uses your net income and if you are married or living common-law your spouse or common-law partners net income to calculate amounts such as the Canada child benefit the GSTHST credit the social benefits repayment and certain credits. You calculate net income for a company by starting with revenue then subtracting all expenses. Some people refer to net income as net earnings net profit or the companys bottom line nicknamed from its location at the bottom of the income statement.

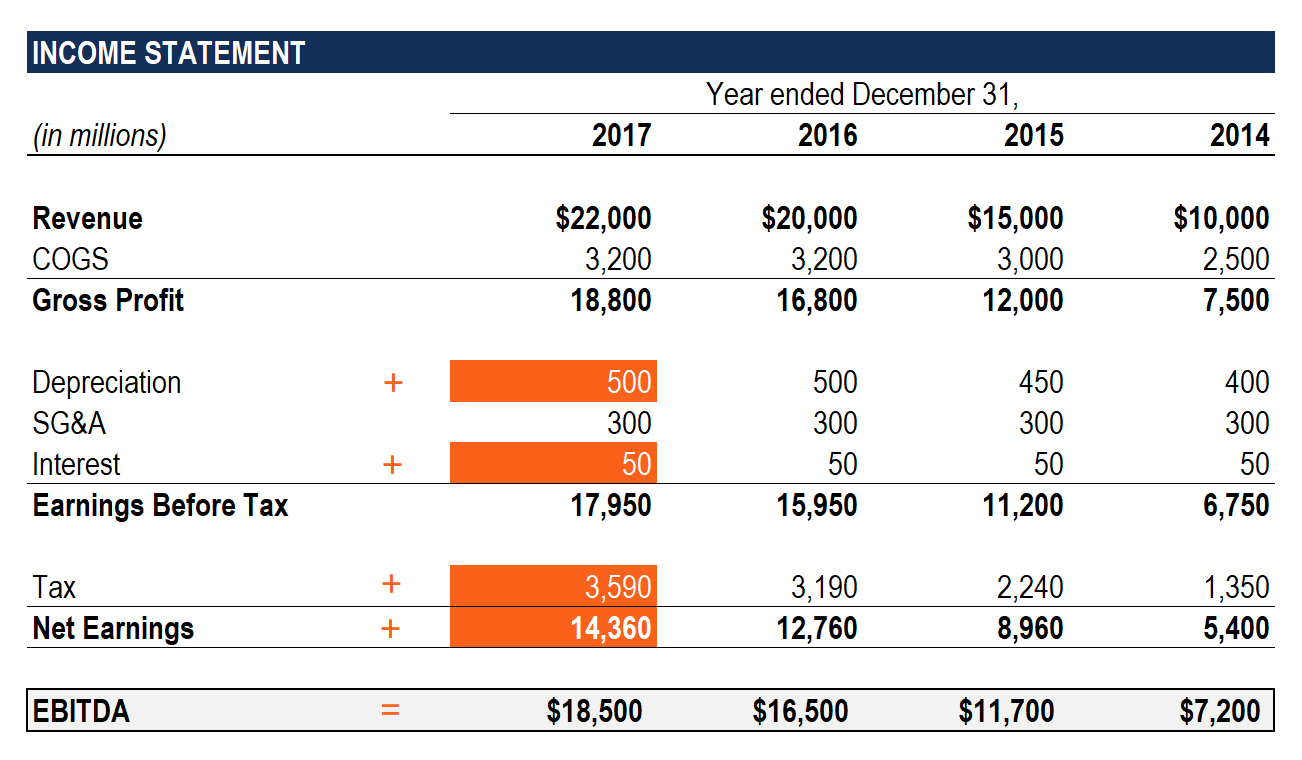

In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period. Net income can also be called net profit the bottom line and net earnings. Also known as Gross Income.

Salary After Tax the money you take home after all taxes and contributions have been deducted. If you are a salaried employee this may be complicated even further. Net income is the amount of money a corporation has earned after subtracting all of the expenses of producing its goods or services from the income or revenue it has realized from sales of those goods or services.

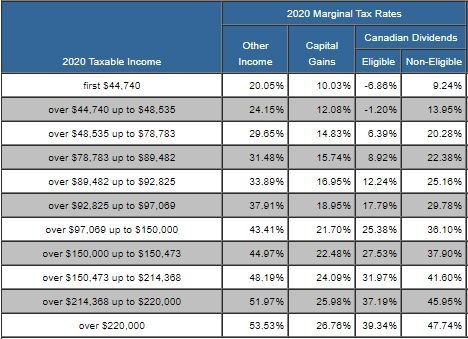

Net income also called net earnings is sales minus cost of goods sold general expenses taxes and interest. Taxes owed to the tax authorities Canada Revenue Agency or CRA are calculated on this Net Income number - more specifically - the difference between your Revenues and Business Expenses. If youre self-employed your net income is your professional income the money you make for providing professional services.

Net income is used to calculate federal and provincial or territorial non-refundable tax credits. Firstly you must add up all your income whether its from one. If youre eligible or already receive an OAS pension its worth checking if you are eligible to receive the GIS payment.

Your net income or combined net income for couples exceeds the maximum annual income threshold. It is equal to your total income minus tax payments and pretax contributions. Its used to determine your federal and provincial or territorial non-refundable credits or any social benefits you receive like the GSTHST credit or the Canada child benefit.

Net income is the bottom line on a businesss income statement. If you have a small businesses net income is your business income the revenue for selling products or services minus your deductible expenses. If you want to see how youre doing from a wealth perspective by age you can visit this page.

Using the last example if you earned 450 in gross pay your net pay will be the amount that ends up in your bank account after taxes and other fees have been taken out. The net income of a company is the result of a number of calculations beginning with revenue and encompassing all expenses and income streams for a given period. Net employment income is your employment income minus the related employment expenses you are claiming.

Net income is the amount of money thats left after taxes and certain deductions are made from gross income. Net pay is the amount of money that will finally be available to you. Learn what is included in net income and why it is important to your financial life.

It is also called earnings profits or the bottom line. To figure out your net income subtract the cost of goods sold operating expenses interest and depreciation charges taxes and any miscellaneous expenses from your net revenue. It is what is left of your revenue after youve covered your expenses.

Your net income is calculated by subtracting all allowable deductions from your total income for the year. In Canada if you have a small business or are a self-employed professional you report your net income on Form T2125 at tax time. Lets use an example.

For a corporation operating in Ontario Canada earning under 500000 in Net Income the tax rate is 155. Its the amount of money you have left over to pay shareholders invest in new projects or equipment pay off debts or save for future use. What Is Net Income.

Net income is your companys total profits after deducting all business expenses. The sum of income. Like the name implies total income refers to income that is.

Your total earnings before any taxes have been deducted. Also known as Net Income. For example if your employer agreed to pay you 45000 a year with bi-monthly pay periods your gross pay.

Net income is the money left as profits after subtracting all costs and expenses from revenue.

Canada Child Benefit Vs The Universal Child Care Benefit 2021 Turbotax Canada Tips

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba Business Strategy Netflix Business Model Business Case Study

Here S How Much Canadians Are Earning By Province Workopolis Blog

Income Statement Definition Explanation And Examples

Earnings Before Tax Ebt What This Accounting Figure Really Means

Net Income The Profit Of A Business After Deducting Expenses

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

Average Canadian Salary In 2020 Jobillico Com

What Is Ebitda Formula Definition And Explanation

Net Income The Profit Of A Business After Deducting Expenses

What Income Level Is Considered Rich Financial Samurai

Ability To Pay Taxation Overview How It Works Example

Canada Child Benefit Vs The Universal Child Care Benefit 2021 Turbotax Canada Tips

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Net Income The Profit Of A Business After Deducting Expenses

8 Ways To Pay For A Recovery Universal Basic Income

All About Foreign Tax Credit And Its Indian Context

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Net Income Meaning Canada"